The governments of Dubai and Hong Kong have signed an agreement to establish an economic corridor for promoting cross border trading and strengthening cooperation in financial services.

The partnership will also support the development of family offices and collaboration between the two cities in fintech, virtual assets and green finance.

Dubai’s Department of Economy and Tourism (DET) and Hong Kong’s Financial Services and the Treasury Bureau signed the Memorandum of Understanding (MOU) at the two-day Belt and Road Summit in Hong Kong.

The MoU supports the goals of the Dubai Economic Agenda D33, to consolidate Dubai’s status as one of the world’s top three cities and double the city’s economy in the next decade.

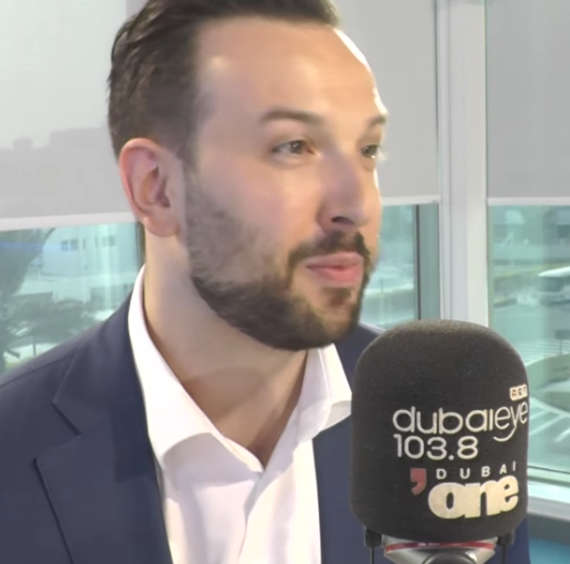

"This strategic alliance is another milestone for Dubai and symbolises our commitment towards realising the vision of our leadership’s ambitions to position Dubai as one of the world’s top four global financial capitals, as well as building an economic corridor in partnership with Hong Kong, China to generate incremental and sustainable economic growth," said Hadi Badri, CEO of the Dubai Economic Development Corporation at DET.

#Dubai and Hong Kong forge financial services partnership to activate economic corridor. @DubaiDET & Financial Services and the Treasury Bureau of the Government of the Hong Kong Special Administrative Region of China sign MoU at the Belt and Road Summit. https://t.co/XEyphJLs4x pic.twitter.com/Y3vmWe7JLX

— Dubai Media Office (@DXBMediaOffice) September 14, 2023

UAE, France sign artificial intelligence MoU

UAE, France sign artificial intelligence MoU

ADNOC acquires 10% stake in major Mozambique LNG development

ADNOC acquires 10% stake in major Mozambique LNG development

UAE scores high on WEF's travel, tourism index

UAE scores high on WEF's travel, tourism index

Europe sets benchmark for rest of the world with landmark AI laws

Europe sets benchmark for rest of the world with landmark AI laws

DXB enjoys record-breaking first quarter

DXB enjoys record-breaking first quarter