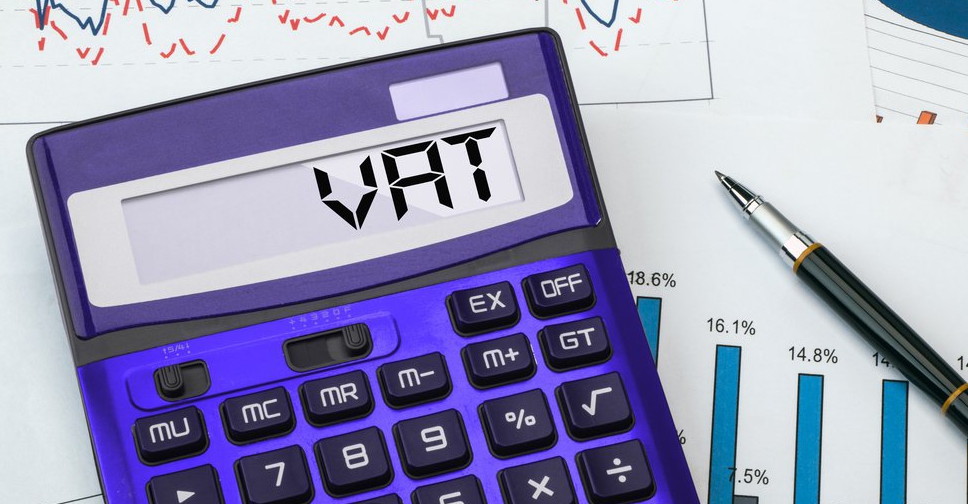

The UAE's Ministry of Finance has announced amendments to some provisions of the Federal Decree-Law No. 8 of 2017 on Value Added Tax (VAT), which will be effective from January 1, 2023.

The amendments made are in line with international best practice in light of the GCC Unified VAT Agreement.

They are based on past experiences, challenges faced by various business sectors as well as the recommendations received from the relevant parties.

Some of the major amendments include the following:

- Registered persons who make taxable supplies are allowed to apply for an exception from VAT registration if all of their supplies are zero-rated or if they no longer make any supplies other than zero-rated supplies.

- Setting a 14-day period to issue a tax credit note to settle output tax, in line with the time frame set for issuing tax invoices.

- The Federal Tax Authority (FTA) may forcibly deregister registered persons in specific cases if deemed necessary.

Furthermore, the Decree-Law includes amendments to certain provisions to clarify and confirm the intended meaning of the text; to rephrase; or to improve the legislative sequence of legal provisions.

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact

Elon Musk visits China as Tesla seeks self-driving technology rollout

Elon Musk visits China as Tesla seeks self-driving technology rollout

Abu Dhabi Airports welcomes 6.9 million passengers in three months

Abu Dhabi Airports welcomes 6.9 million passengers in three months

ByteDance denies media report of plan to sell TikTok

ByteDance denies media report of plan to sell TikTok

Photos: UAE’s first operational vertiport unveiled in Abu Dhabi

Photos: UAE’s first operational vertiport unveiled in Abu Dhabi