Stock markets inched higher but the Mexican peso was mixed after the third and final US presidential debate, which was judged to have given no clear boost to Republican candidate Donald Trump's hopes of winning the White House. The peso is seen as the chief proxy for market pricing of Trump's chances in view of his promises to impose tough limits on immigration. It climbed to a six-week high against the dollar in the immediate aftermath of the debate but was down on the day in European trade. A win for Democrat Hillary Clinton next month - now predicted clearly by polls - is also seen as opening the way for a rise in interest rates which a number of US Federal Reserve policymakers have all but promised for December. The peso lost 0.3 per cent in early European trade to stand at 18.567 per dollar. Against a basket of currencies used to measure its broader strength, the dollar was up just under 0.1 per cent, close to seven-month highs hit earlier this week.

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

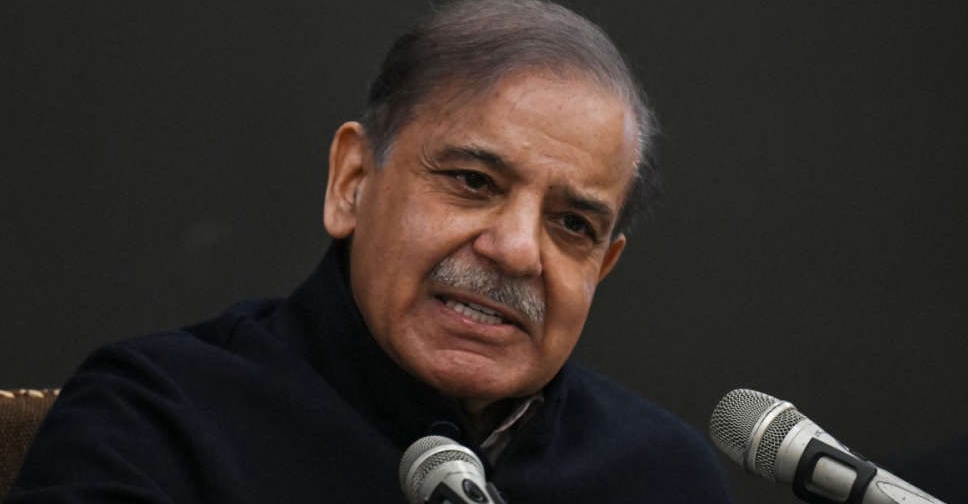

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact