Saudi Arabia’s central bank directed local lenders to reschedule the consumer loans of clients affected by a decision to scrap the bonuses and allowances enjoyed by many state employees. The Saudi Arabian Monetary Agency, as the central bank is known, said in a statement on Sunday the step would “reduce pressure on borrowers” whose income was cut by the government’s September 26 package of measures to trim spending. The agency said local banks must obtain each client’s approval before rescheduling a loan. Borrowers should present proof that their income has been affected by the recent cuts to the nearest bank branch, the regulator said. Loans taken after the cabinet decision to end the payments won’t be rescheduled. Under Deputy Crown Prince Mohammed bin Salman, the world’s biggest oil exporter has already delayed payments owed to contractors and started cutting fuel subsidies as it tries to manage lower oil prices. The measures may help narrow the budget deficit to 13 per cent of gross domestic product this year and below 10 per cent in 2017, according to International Monetary Fund estimates.

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

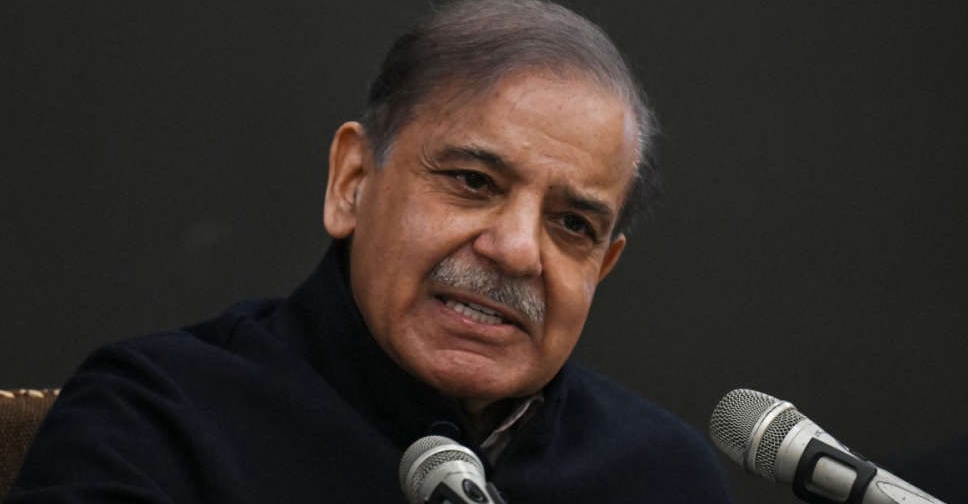

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact