The Philippine central bank can refrain from raising its policy rate in the first half of this year with inflation still within the target, but risks are rising, Governor Amando Tetangco said. “Barring surprises and given the current outlook, we can keep rates unchanged in the next six months,” Tetangco said in an interview on Monday. “We don’t see anything pressing in the horizon to warrant a cut. The risks are on the upside” and the central bank’s next move will depend on upcoming economic data, he said in his office in Manila. Tetangco, 64, is nearing the end of his second, six-year term at the helm of Bangko Sentral ng Pilipinas in July and is barred by law from extending his tenure. A veteran of more than four decades at the central bank, Tetangco has kept inflation below 5 per cent for more than five years and cut the benchmark interest rate to a record low. His possible departure comes at a time of heightened risks for the economy as the US tightens monetary policy, political uncertainty mounts and the government could stall on passing tax measures needed to sustain economic growth. (Siegfrid Alegado and Clarissa Batino/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

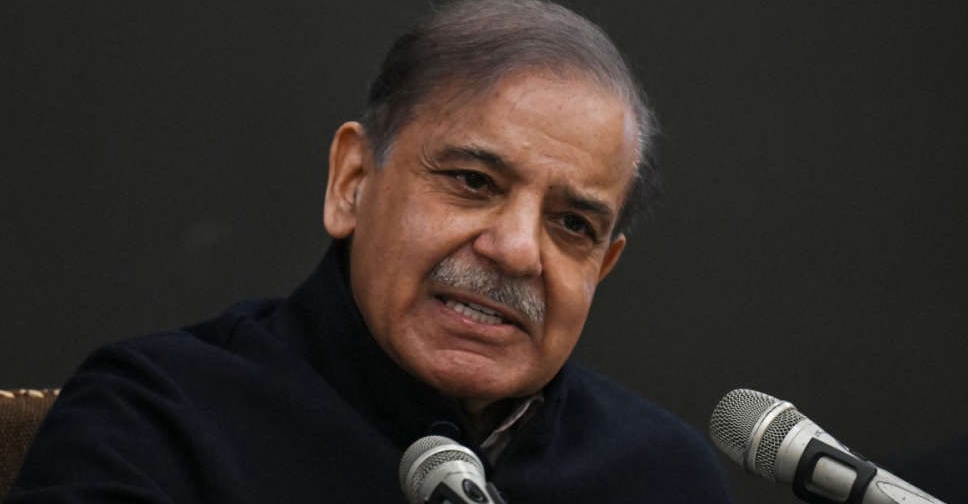

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact