Philippine billionaire Manuel Villar, who made a fortune building affordable homes, is considering merging his residential and shopping mall units as he turns housing projects across the country into self-contained communities. Combining Vista Land & Lifescapes Inc., the biggest Philippine homebuilder, with the income stream from shopping-centre developer Starmalls Inc. “could make sense," according to Villar, a former politician who’s chairman of both companies. The two have a combined market value of about $2.5 billion (AED9.18 billion) and the stakes held by the tycoon and his family are worth together more than $1 billion, according to data compiled by Bloomberg. “That is always a topic of debate among our officers and among our bankers," Villar said in an interview on the sidelines of the Forbes Global CEO Conference in Manila last week. “We are looking into that.” A similar move in 2013 by Philippine billionaire Henry Sy, the nation’s richest man, catapulted his SM Prime Holdings Inc. from the country’s biggest shopping mall operator into the biggest developer by market value, unseating Ayala Land Inc. The merger allowed SM Prime to undertake projects other than shopping centers and develop what it calls “micro cities" around its malls. Low-Cost Homes Vista Land, which sells homes priced as low as 500,000 pesos (AED39,865), has a market value of 45.3 billion pesos, while Starmalls, which has nine shopping centers, is worth 68.8 billion pesos. Villar’s plan “allows immediate diversification,” said Robert Ramos, Manila-based chief investment officer at Union Bank of the Philippines. “While the housing market is expected to continue growing, there is also a preference for developers with a steady income from leasing and rent.” Vista Land, which has a presence in 92 towns and cities in 35 provinces, has identified 23 residential projects that can be developed into what Villar calls “communicities" by adding shopping malls, grocers, department stores, schools, hotels and hospitals. In areas where there’s demand, offices will be built for outsourcing companies, he said. Vista Land will develop these communities, while Starmalls provides the large-box shopping centers and offices, Villar said. Vista Land has also built shopping arcades in some of its projects. Anticipating Needs “What do homeowners need? You need to shop. You need to watch movies,” Villar said. “We want to provide all of that.” The tycoon’s All Day convenience stores has 70 outlets that will continue to expand, while his supermarket, which just started, is rolling out its second and third outlets. All Home, his home-improvement shop, will have 12 stores by year-end, with the prospect of growing into a chain of 50 outlets across the country, he said. Villar, a former senator who lost in the 2010 presidential elections, is estimated by Forbes magazine to have a $1.56 billion net worth. He returned as Vista Land chairman in 2013 to work with his son Manuel Paolo Villar, who’s president of the company. “The land bank we have, the nationwide presence we have, is a big advantage, so I told myself why limit yourself to houses,” he said. "We have big plans for the group." (By Ian C Sayson Cecilia Yap/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

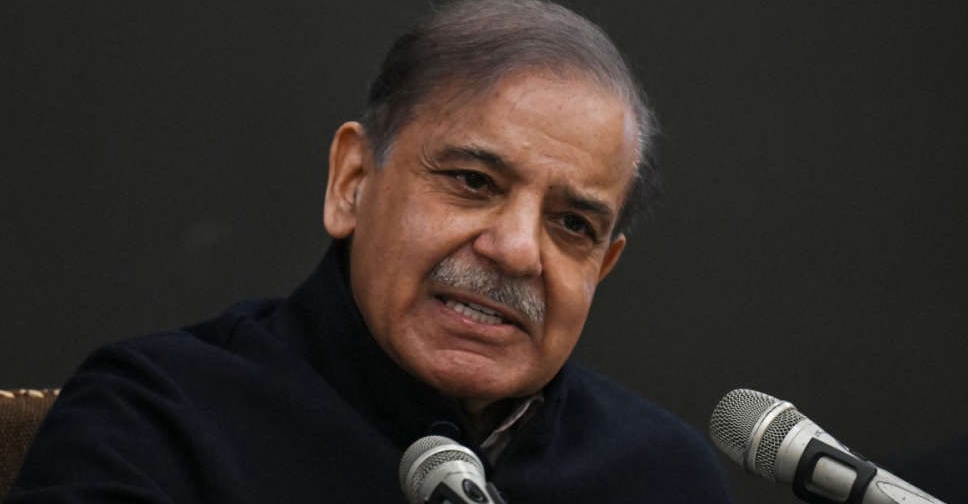

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact