The Organisation of Petroleum Exporting Countries (OPEC) talks in Vienna Tuesday didn’t resolve whether Iraq and Iran will join any production cuts, instead deferring the crucial matter to ministers who will meet on November 30, said two delegates. While Libya’s OPEC governor Mohamed Oun said the meeting ended with a consensus that will be presented to ministers, he declined to comment on whether the group’s second and third largest members are willing to limit output. The continuing questions around Iranian and Iraqi production don’t make a deal impossible next week, the delegates said, asking not to be named because the talks are private. However, the lack of agreement Tuesday leaves open the possibility the group fails to implement the cuts first outlined in late September. Officials leaving the OPEC headquarters in Vienna told reporters they have agreed on most details and that they were happy with the outcome of Tuesday’s talks. But on top of the pending Iran and Iraq issue, securing cooperation from non-members including Russia has emerged as a mounting concern among some OPEC countries, said one delegate. Saudi Arabia and its allies in the 14-nation group want Russia to cut output rather than freeze it, the delegate said. (Grant Smith and Angelina Rascouet/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

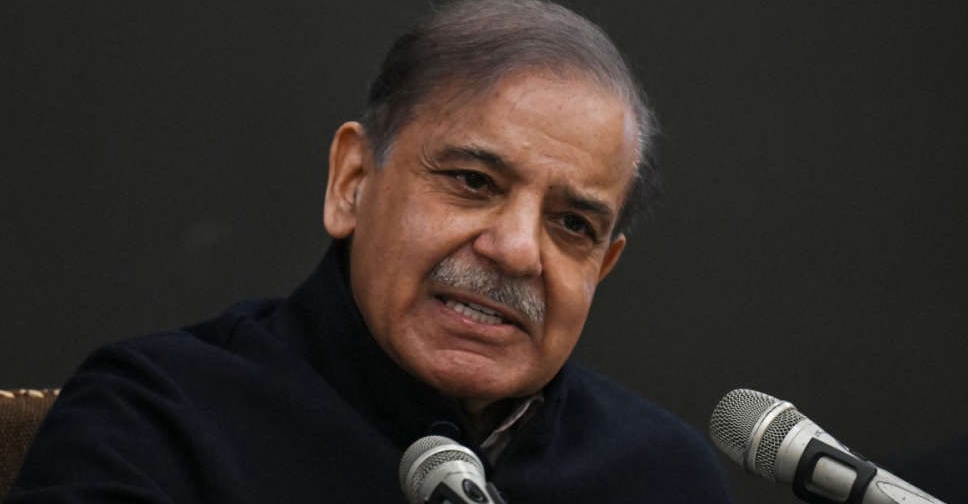

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact