Foreign investors’ renewed interest in Indian equities faces a big test as Indian Prime Minister Narendra Modi’s government prepares to present the federal budget. Investors say the first stock inflows from overseas in more than a month could accelerate if the February 1 budget unveils steps to boost spending to stimulate growth that’s forecast to slow to a three-year low. On the other hand, a move to end a tax break on equity gains or a levy on foreigners will once again sour the sentiment for India just when the markets are facing uncertainties over Brexit and US President Donald Trump’s economic policies. “The market has a limited appetite for surprises,” said Mihir Vora, who helps oversee about $6 billion as chief investment officer at Max Life Insurance Co. “We’ve withstood demonetisation and other unanticipated events such as a new policy regime in the US. Any changes in tax treatment or rules for foreign investors will impact sentiment.” Global funds last week bought $101 million of shares amid signs the cash crunch from Modi’s shock currency ban is easing, and as the government put on hold a proposal to tax indirect transfers of assets held by foreign investors. The inflows follow $4.3 billion of withdrawals since November, the highest among eight Asian markets tracked by Bloomberg. (Ameya Karve and Nupur Acharya/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

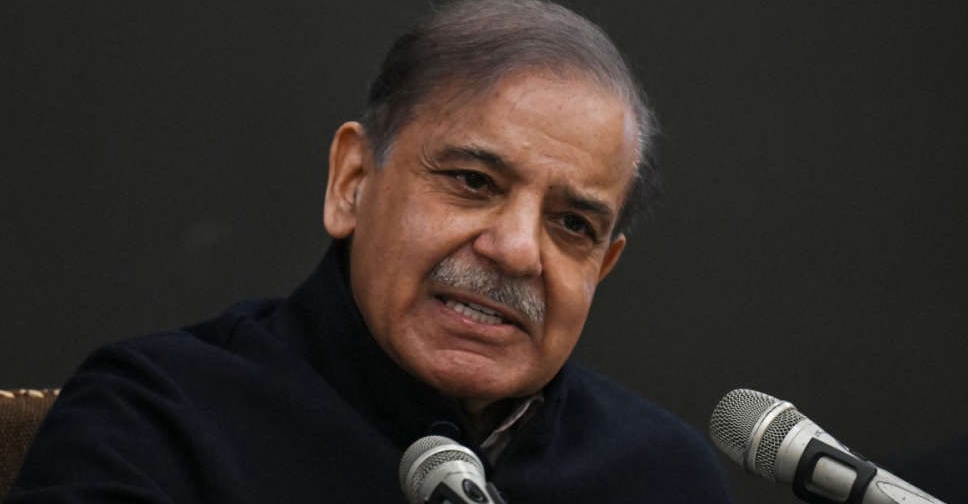

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact