Irish Finance Minister Michael Noonan will on Wednesday take his fight over Apple Inc.’s record 13 billion Euro ($14.4 billion) tax bill to a European Union court, potentially triggering years of litigation. The nation will file its appeal against the European Commission’s decision to force Ireland to claw back alleged tax subsidies, in a case that will test the EU’s powers to use state aid law in what governments argue are national affairs. The challenge at the EU General Court in Luxembourg will join a handful of pending appeals by other EU nations and companies that received similar decisions in the past year, targeting tax rulings regulators deemed to be unfair. The EU’s Apple decision was the biggest ever state-aid payback demand. “The government fundamentally disagrees with the European Commission’s analysis and the decision left the government no choice but to take an appeal to the European courts, and this will be submitted tomorrow,” Noonan said at the European Parliament in Brussels Tuesday. The Apple decision, which followed a three-year probe, is part of a wider EU campaign against corporate tax avoidance. The August 30 decision in the Apple case attracted strong reactions from the US Treasury Department, which has criticised the Brussels-based watchdog’s state aid probes because they “threaten to undermine foreign investment, the business climate in Europe, and the important spirit of economic partnership between the US and the EU.” (Stephanie Bodoni/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

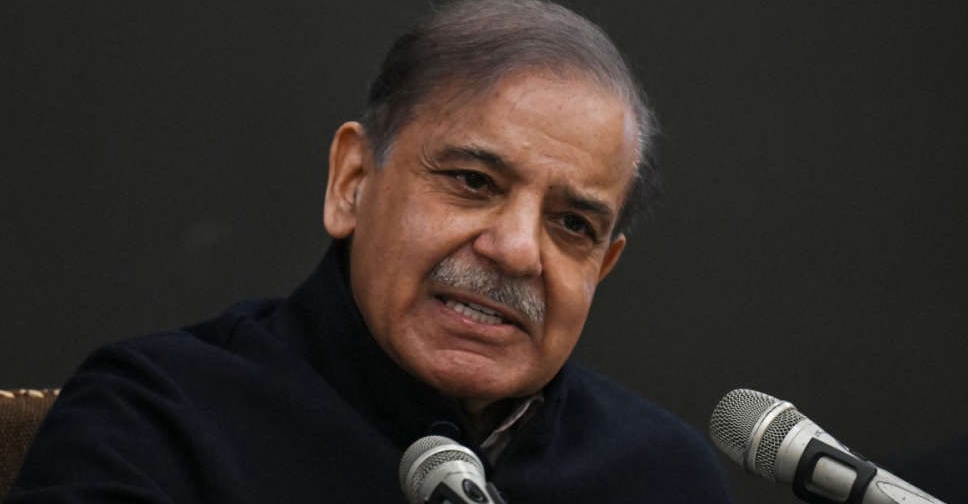

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact