Emirates NBD PJSC reported third-quarter profit that missed analysts’ estimates as UAE's biggest bank was hurt by bad loan provisions at its Islamic unit. Net income was AED 1.66 billion ($453 million), little changed from AED 1.67 billion in the year earlier period, the lender said in a statement on Monday. The mean estimate of five analysts was for a profit of AED 1.83 billion. While overall impairments fell 11 percent, they almost doubled at its Islamic unit to AED 455 million, the bank said in a separate statement. “Whilst we have seen increased delinquencies in the micro small and medium enterprise segment, which has prompted Emirates Islamic to take additional provisions, the group’s overall credit quality continues to improve," Group Chief Executive Officer Shayne Nelson said in the statement. Banks in the UAE are prepared for deteriorating conditions as oil prices remain lower for longer and asset quality worsens, S&P Global Ratings said earlier this year. Emirates Islamic Bank PJSC, the lender’s Islamic unit, reported a third-quarter loss of AED 31 million compared to AED 87 million profit a year ago.

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

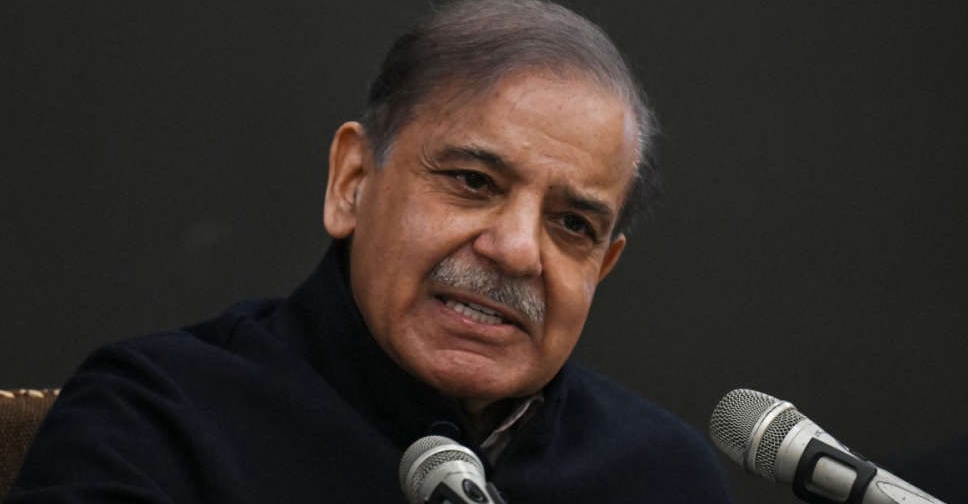

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact