Hawala providers and financial institutions have been issued a new set of guidelines in an effort to combat money laundering and the financing of terrorism.

These new rules were issued by the Central Bank of UAE and came into effect yesterday.

Providers must have a competent compliance officer, conduct appropriate customer and agent due diligence, monitor transactions and maintain records.

They are also required to have an account with a bank operating in the UAE to be used for settlements.

Legitimate hawala providers are considered to be an important element that helps boost financial inclusion.

These providers are overseen by the Registered Hawala Providers Regulation issued by the Central Bank in 2019.

The governor of the central bank said that they will continue to keep a “close eye” on licensed financial institutions and registered hawala providers in the country to ensure that all local regulations are followed and to safeguard the country’s financial system.

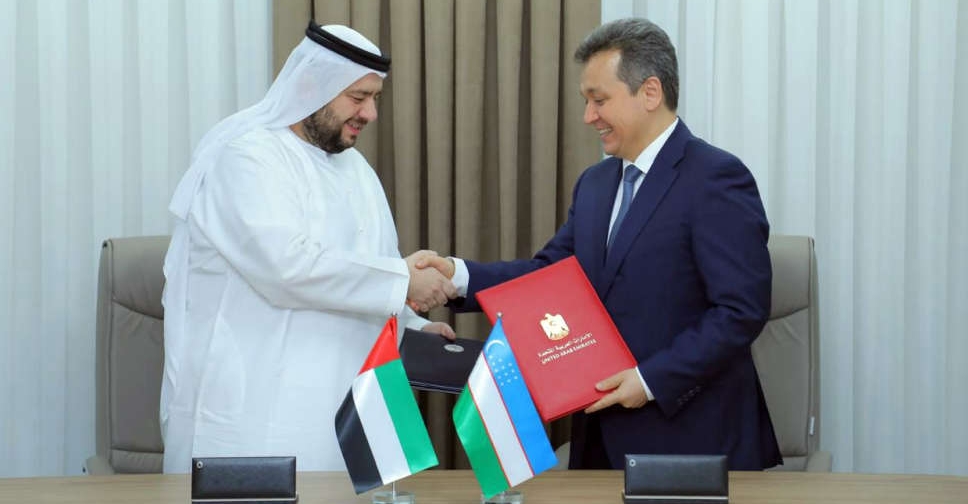

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal

TECOM Group profit increases 15% on record high occupancy levels

TECOM Group profit increases 15% on record high occupancy levels

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

Sony and Apollo submit $26 billion Paramount offer, WSJ reports

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering