Aramex PJSC, the Dubai-based courier and logistics company, is considering minimising its operations in the UK and serving Europe through the Netherlands or France if Brexit agreements do not favour free trade flows. The company, which is listed on the Dubai Financial Market, would maintain a small hub in the UK but move the bulk of its operations if the UK and European Union don’t reach an agreement supporting free commerce, which is crucial to the logistics business, according to Aramex Chief Executive Officer Hussein Hachem. “It depends on what kind of agreement the UK government would be able to reach with the EU,” Hachem said Monday in an interview in Dubai. “The UK is a big economy. Irrespective of what happens, we need to have a presence. It’s too early to take a decision right now, but we’re mobile. It’s about customs. If that’s been addressed, we will stick around. If it’s a challenge, then we will minimise the UK hub and move somewhere else.” International companies have started to consider shifting jobs and set up offices within the EU after UK Prime Minister Theresa May indicated she’ll pull Britain out of the single market. Aramex calls for open borders and the non-tariff flow of goods, Hachem said. The company has about 200 employees in the UK. (Deena Kamel Yousef and Yousef Gamal El-Din/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

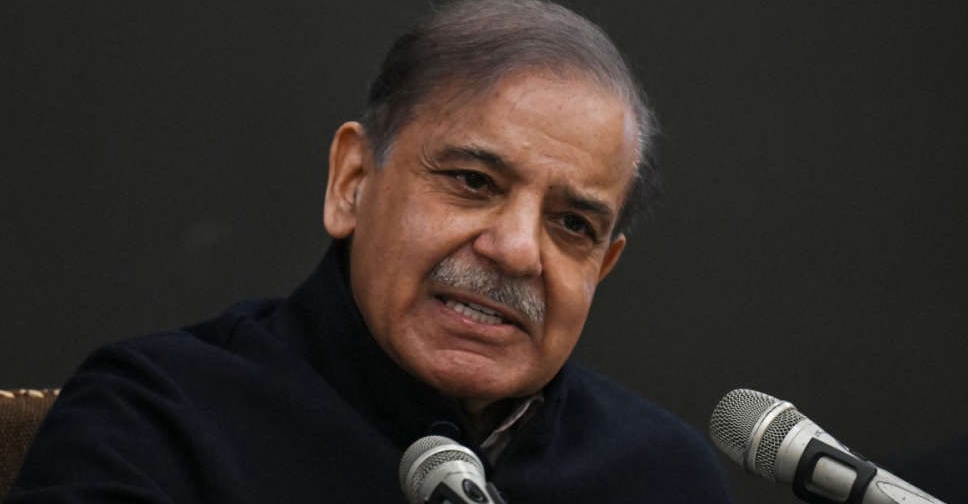

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact