African ministers meeting in Cairo two months ahead of the COP27 climate summit called on Friday for a sharp expansion of climate financing for their continent while pushing back against an abrupt move away from fossil fuels.

Egypt, an oil and gas producer considered highly vulnerable to climate change, has positioned itself as a champion for African interests as it prepares to host the summit in Sharm el-Sheikh in November.

A communique released after a three-day forum for finance, economy and environment ministers said Africa benefited from less than 5.5 per cent of global climate financing despite having a low carbon footprint and suffering disproportionately from climate change.

It urged rich countries to meet and expand climate pledges and said poor countries should be able to develop economically while receiving more funds to adapt to the impact of climate change.

The document stressed "the need to avoid approaches that encourage abrupt disinvestments from fossil fuels, as this will... threaten Africa's development".

The role of gas in the transition to cleaner energy is set to be a key point of contention at COP27. Climate activists say it needs to be quickly phased out and replaced with renewables.

Nigerian Finance Minister Zainab Ahmed told the Cairo forum that gas was a matter of survival for her country.

"If we are not getting reasonably-priced finance to develop gas, we are denying the citizens in our countries the opportunities to attain basic development," she said.

The communique also called for focusing on climate change in a review of multilateral development banks and international financial institutions.

It suggested the creation of a sustainable sovereign debt hub that could reduce the cost of capital for developing states and support debt-for-nature swaps.

Experts say there is private as well as public sector appetite for financing and investing in climate projects in Africa, but funding is hindered for reasons including risk perception, underdeveloped green finance markets, and local technical and policy constraints.

States have seen their cost of borrowing rise due to the COVID-19 pandemic and the war in Ukraine.

"This is keeping us up at night – how to decrease the cost of borrowing," Egypt's Deputy Finance Minister Sherine El Sharkawy told the forum.

Kevin Chika Urama, the chief economist at the African Development Bank, said Africa faced a climate financing gap of about $108 billion each year.

"Climate finance structure today is actually biased against climate-vulnerable countries. The more vulnerable you are, the less climate finance you receive," he said.

UAE, Iran expand cooperation in additional sectors

UAE, Iran expand cooperation in additional sectors

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

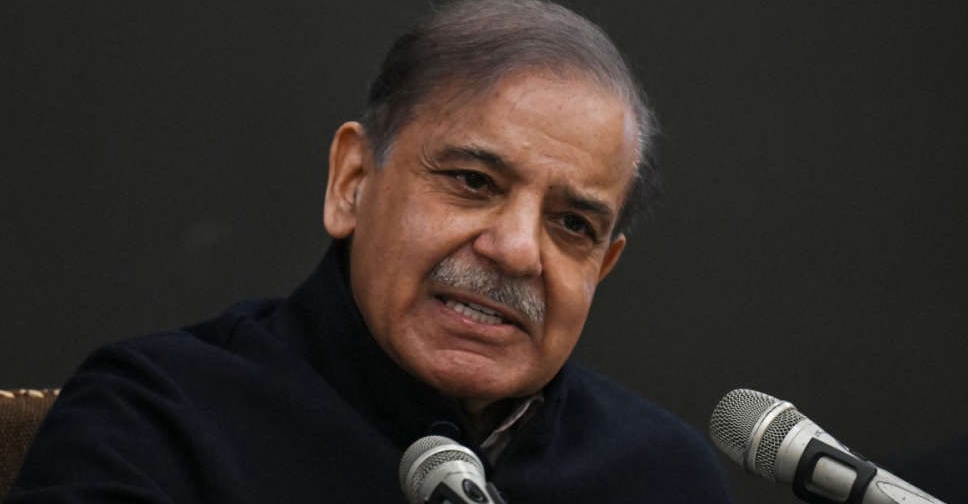

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif