ABN Amro Group NV, the nationalised Dutch lender, narrowed the price range of its shares on sale in an initial public offering. A deal update sent to investors late Wednesday said the bank narrowed the range to 17.50 euros to 18 euros, from an original range of 16 euros to 20 euros. The IPO has demand for all shares within the new range, the terms showed. The government is selling a 23 percent stake in the nationalized lender in an offering that may raise as much as 4.3 billion euros ($4.6 billion). Books close Thursday. The state, which spent 22 billion euros to bail out the bank following the 2008 financial crisis, is seeking to recoup part of its investment in the first of a series of stake sales. The offering is shaping up be Europe’s largest banking IPO since Russia’s VTB Bank raised 6 billion euros more than eight years ago. The shares are set to begin trading in Amsterdam on Friday under the symbol ABN. Morgan Stanley, Deutsche Bank AG and ABN Amro are managing the IPO, along with Bank of America Corp., Barclays Plc, Citigroup Inc., JPMorgan Chase & Co., ING Groep NV and Rabobank. (By David de Jong and Ruth David/Bloomberg)

Former Binance chief guilty of money laundering

Former Binance chief guilty of money laundering

Emirates attracts pilots with higher salaries, new perks

Emirates attracts pilots with higher salaries, new perks

Spinneys increases IPO retail offering due to high demand

Spinneys increases IPO retail offering due to high demand

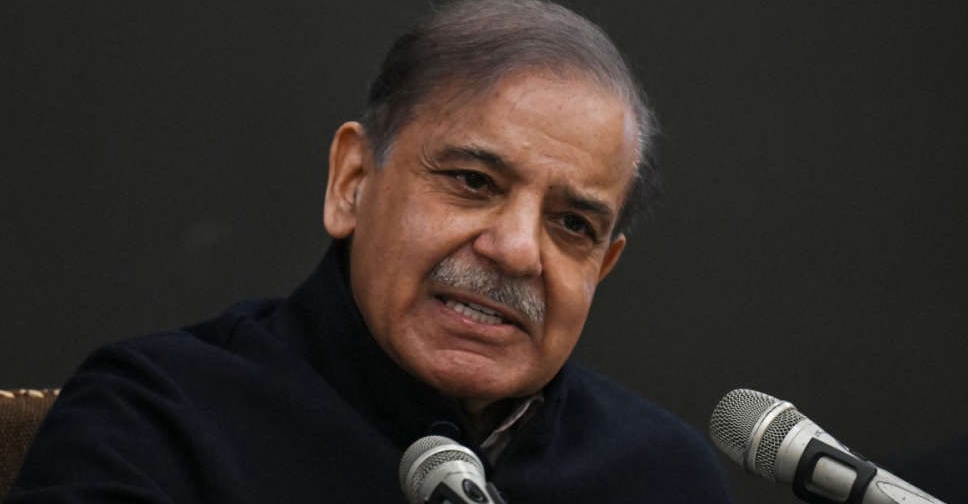

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

IMF $1.1 billion tranche to help Pakistan's economic stability, says PM Sharif

UAE, Ukraine conclude terms of trade pact

UAE, Ukraine conclude terms of trade pact