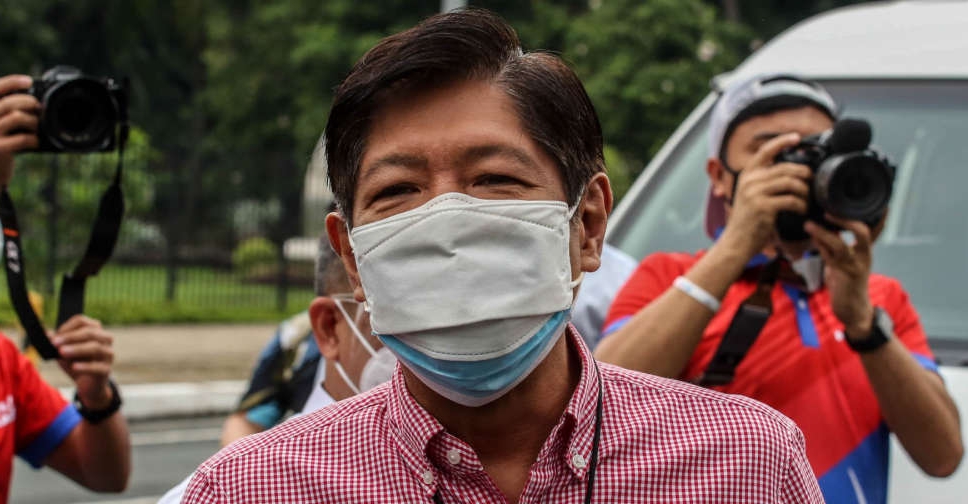

The Philippines Commission on Elections has dismissed consolidated petitions seeking the disqualification of presidential candidate Ferdinand Marcos Jr.

The petitions were dismissed for "lack of merit", James Jimenez, a spokesperson for the commission said on Twitter.

The complaints centred on decades old tax offences that Marcos was convicted of while in public office, which petitioners said should have made him ineligible to run in any election, citing a tax law that prescribes a lifetime ban.

One of the petitioners described the commission's decision as a "major setback for the country's electoral democracy".

"It is a missed opportunity to defend the truth and protect the public from a large-scale election swindle by a convicted tax evader," left-wing Akbayan group said in statement.

There was no immediate comment from Marcos.

A division of the poll body last month dismissed a separate complaint seeking to block his presidential bid, ruling that his prior tax violations should not derail his run.

Marcos has emerged as a clear favourite in the May 9 elections to choose a successor to President Rodrigo Duterte.

Apart from Marcos, also vying for presidency are vice president Leni Robredo, boxing superstar Manny Pacquiao, Manila mayor Francisco Domagoso and senator Panfilo Lacson, among others.

Taiwan rattled by dozens of quakes, but no major damage

Taiwan rattled by dozens of quakes, but no major damage

Prosecutors say Trump corrupted 2016 election

Prosecutors say Trump corrupted 2016 election

Israeli military intelligence head resigns over October 7 failures

Israeli military intelligence head resigns over October 7 failures

Israeli PM Netanyahu says he will fight any sanctions on army battalions

Israeli PM Netanyahu says he will fight any sanctions on army battalions

Rescuers race to reach those trapped in China's Guangdong floods

Rescuers race to reach those trapped in China's Guangdong floods