China and Hong Kong stocks started lower on Thursday as investors priced in heightened tensions around security and trade in a second Donald Trump presidency, with losses contained by expectations from a key Chinese leadership meeting.

China's blue-chip CSI300 Index opened down 0.9 per cent, while the Shanghai Composite Index lost 0.7 per cent. Hong Kong benchmark Hang Seng .HSI was down 0.7 per cent.

The drop was led by exporters. Stocks are expected to extend their decline in the days ahead as markets await US Congressional election results and brace for a Republican sweep which could give Trump greater sway over taxes and tariffs.

Hong Kong's Hang Seng, which is more indicative of foreign investor sentiment, fell 2.3 per cent on Wednesday. The Hang Seng China Enterprises Index opened 0.3 per cent weaker after it fell 2.6 per cent on Wednesday.

A threat by Trump, who has been elected as the next US president, to impose 60 per cent tariffs on US imports of Chinese goods, poses major growth risks for the world's second-largest economy.

Meanwhile, investors' attention shifted to the National People's Congress Standing Committee meeting which concludes on Friday. Any stimulus surprise from the meeting will likely help lift market sentiment in China stocks.

DXB to welcome over 4.2 million guests over next two weeks

DXB to welcome over 4.2 million guests over next two weeks

UAE, India review strategic partnership during joint sessions in Abu Dhabi

UAE, India review strategic partnership during joint sessions in Abu Dhabi

Mubadala, Barings launch $500 million global real estate debt partnership

Mubadala, Barings launch $500 million global real estate debt partnership

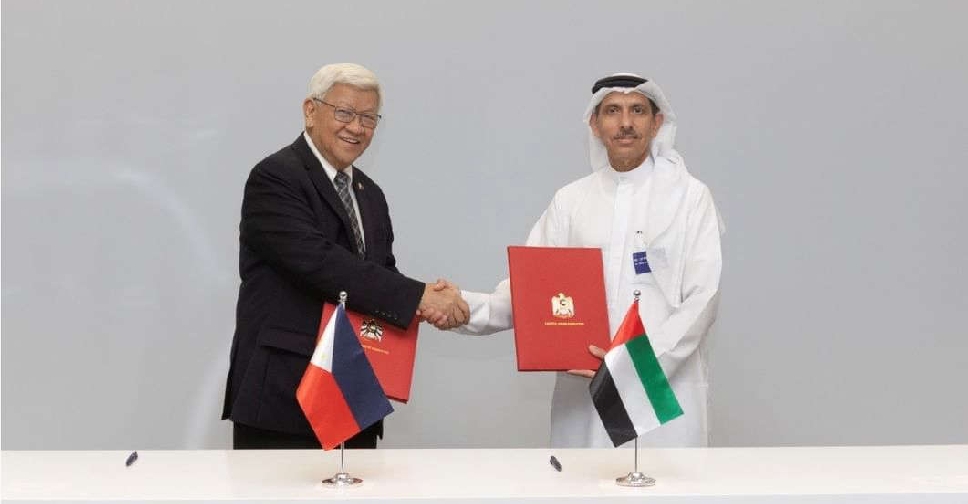

UAE, Philippines agree on additional flight rights

UAE, Philippines agree on additional flight rights

Dubai launches nationwide campaign to combat economic fraud

Dubai launches nationwide campaign to combat economic fraud