The UAE has pledged $200 million (nearly AED 735 million) to help climate resilience in vulnerable countries.

The announcement, which came during the World Climate Action Summit (WCAS), follows up from a previous pledge of $200 million to support development in low-income nations earlier this year in Marrakech.

The commitment comes in the form of Special Drawing Rights (SDRs), pledged to the International Monetary Fund's (IMF) Resilience and Sustainability Trust (RST).

The RST provides long-term concessional funding for climate resilience and pandemic preparedness. It supports climate resilience in low- and middle income economies and countries vulnerable to the impacts of climate change.

“The UAE is delighted to announce our SDR commitment to the IMF Resilience and Sustainability Trust (RST). We are committed to supporting those countries and communities who have often contributed the least to climate change but are impacted the most,” said COP28 President Dr. Sultan Al Jaber.

The UAE is pledging $200 million USD to the IMF Resilience and Sustainability Trust.

— COP28 UAE (@COP28_UAE) December 1, 2023

Such concessional financing, which includes lower interest rates, has a huge impact on building climate resilience in the most vulnerable countries and communities.#COP28 #UniteActDeliver… pic.twitter.com/DcvsT0qKNu

SDRs are a stable asset, pegged against a basket of five currencies – the US Dollar, the Euro, the Chinese Reminbi, the Japanese Yen, and the British Pound Sterling - which IMF members can exchange for a freely usable currency when needed.

The RST was established in 2022 as a response to the need to support low and middle-income economies and vulnerable countries as they confront longer-term climate change risks.

Concessional financing represents loans that are on more favourable terms than the borrower could obtain in the debt markets. This either relates to terms where the loan has low (below market rate) interest rates, or the recipient is granted a grace period or deferred repayment of the loan.

Approximately three-quarters of the IMF’s country membership is eligible for RST financing, including low-income members as well as middle-income countries and small island developing states (SIDS).

Currently, the RST has received over $40 billion to SDR pledges and 11 countries have been approved as recipients so far.

252-tonne UAE aid shipment reaches Gaza

252-tonne UAE aid shipment reaches Gaza

UAE deeply concerned and ready to help search for Iran president

UAE deeply concerned and ready to help search for Iran president

Equiti, Mashreq and Onpassive stations reopen

Equiti, Mashreq and Onpassive stations reopen

UAE flies aid to flood-hit victims in Brazil

UAE flies aid to flood-hit victims in Brazil

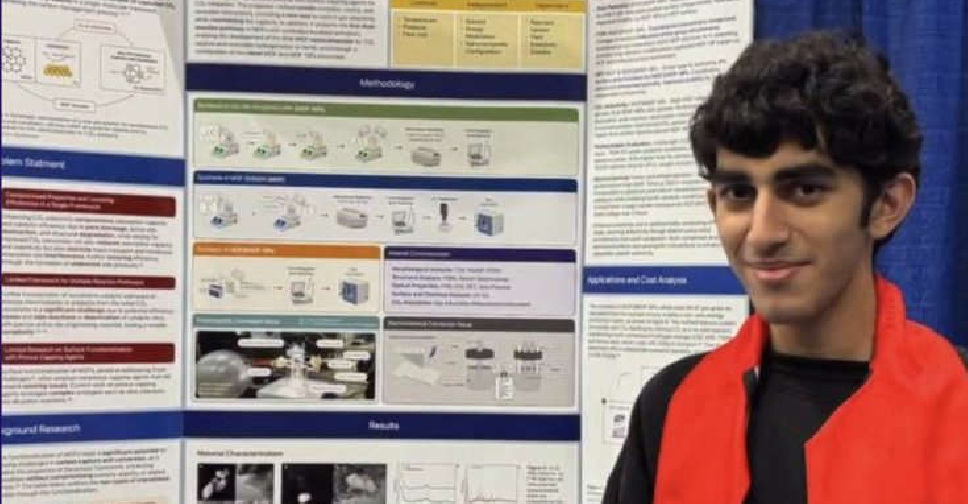

Sharjah student wins third place at ISEF

Sharjah student wins third place at ISEF