Facebook Inc. is taking steps to address its role in spreading fake news, such as enlisting the help of third-party fact checkers and posting warnings on dubious stories. Chief Executive Officer Mark Zuckerberg on Friday responded to criticism that Facebook’s news feed rewarded false stories in the run-up to the US presidential election, including a post that said Donald Trump was endorsed by the Pope. “Normally we wouldn’t share specifics about our work in progress, but given the importance of these issues and the amount of interest in this topic, I want to outline some of the projects we already have underway,” Zuckerberg said on Facebook. Facebook is exploring labelling stories that have been reported as false by third parties or the community so people are warned before they read or share them, Zuckerberg said. The company is also working to make it easier for people to report fake news, and improve technical systems to better detect such articles. Facebook is also turning outside its own organisation for help. It will meet with journalists to understand how they verify information, and is exploring partnerships with third-party fact-checking organisations. (Sarah Frier/Bloomberg)

Record-breaking edition of Arabian Travel Market opens

Record-breaking edition of Arabian Travel Market opens

Latest innovations highlighted at Dubai FinTech Summit

Latest innovations highlighted at Dubai FinTech Summit

Qantas to pay AED 290 million to settle flight cancellation case

Qantas to pay AED 290 million to settle flight cancellation case

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

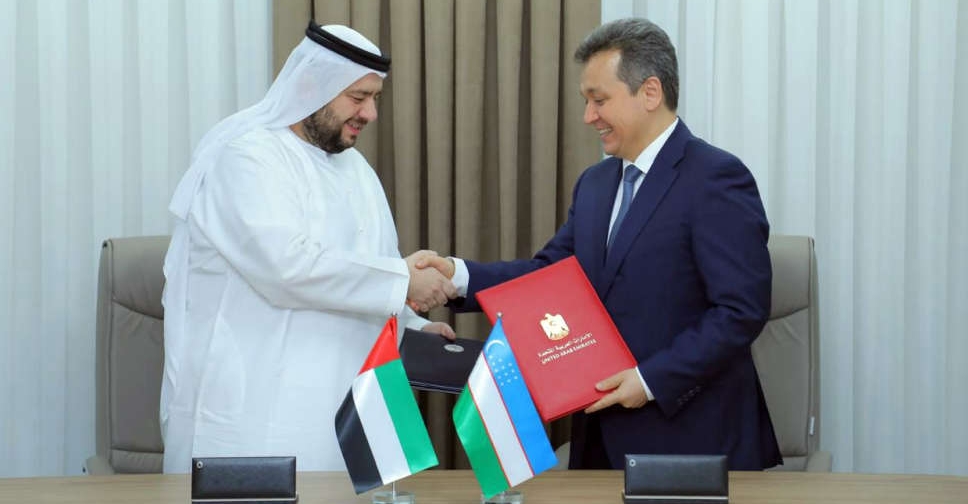

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal