Bilateral trade between the UAE and Israel has reached over AED 2.48 billion within 10 months of signing the Abraham Accords.

That's according to Israeli Foreign Minister Yair Lapid who is on an official visit to the UAE.

"It is estimated that the bilateral trade potential will multiply many times over in the coming years," he told the Emirates News Agency (WAM).

Lapid, who reached Abu Dhabi on Tuesday morning for a two-day visit, is the first Israeli minister to visit the UAE since the Abraham Accords were signed.

This is his second foreign visit since he became the Alternate Prime Minister and Foreign Minister in the new Israeli coalition government formed this month. His first visit was to Rome early this week.

Lapid spoke to WAM in his first interview with a foreign media outlet since became the foreign minister.

His revelation of the latest bilateral trade figure validates the estimates made by some Israeli and UAE officials, soon after announcing the Accords, that even initial bilateral economic engagements would run into hundreds of millions of dollars.

Dubai Government announced on January 30 that the emirate’s trade with Israel in five months (September 2020-January 2021) had reached a value of AED 1 billion (US$272.26 million).

#Israel-#UAE trade stands at $675.22mn, my visit reflects true cooperation: Israeli FM#WamNews https://t.co/Qsf2BLyV0q pic.twitter.com/hIYgaDQC66

— WAM English (@WAMNEWS_ENG) June 30, 2021

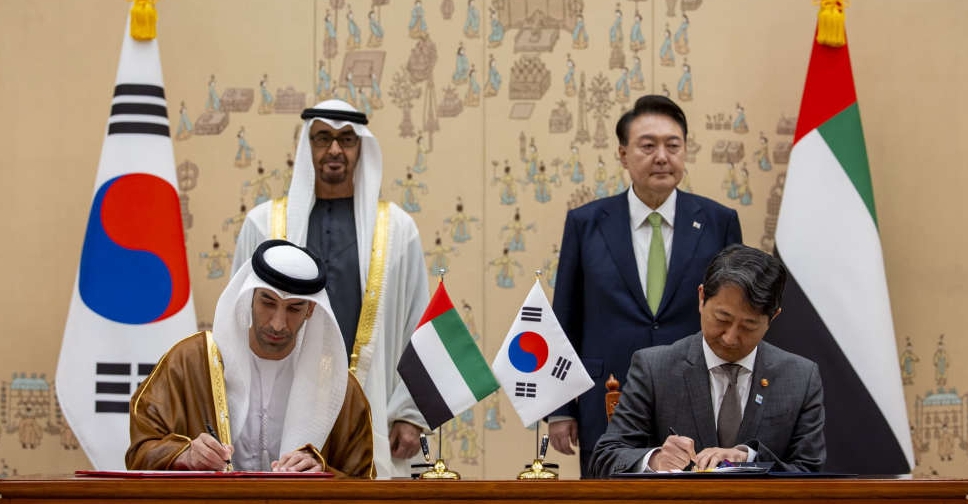

UAE, South Korea formally sign CEPA agreement

UAE, South Korea formally sign CEPA agreement

UAE-Korea business forum shines spotlight on high-growth sectors

UAE-Korea business forum shines spotlight on high-growth sectors

Alef Education to raise up to $515 million in stock market float

Alef Education to raise up to $515 million in stock market float

UAE roads best in region, says World Economic Forum

UAE roads best in region, says World Economic Forum

UAE's industrial sustainability highlighted at 'Make It In The Emirates' forum

UAE's industrial sustainability highlighted at 'Make It In The Emirates' forum