The merger of National Bank of Abu Dhabi and First Gulf Bank to create the Middle East’s largest bank by assets is credit positive for both, according to Moody’s Investors Service Inc. The combined entity will have a pro-forma net interest margin of about 2.1 percent, up from approximately 1.8 percent in the first quarter, Moody’s said in a note to investors on Monday. Profit in the next three years will also benefit from “revenue synergies through cross-selling opportunities, pricing optimization, and cost efficiencies stemming from economies of scale and the consolidation of the branch networks of the two banks,” Moody’s said. Abu Dhabi is combining its largest banks to better compete in size with regional rivals such as Qatar National Bank SAQ and bolster its ability to lend and secure funding as it grapples with a more than 50 percent drop in oil prices over the past two years. The combined bank will operate under the NBAD name and FGB’s shares will be delisted. FGB’s stronger retail business will boost margins and improve NBAD profitability, while FGB’s depositors and senior creditors will benefit from being transferred to NBAD, a larger and stronger entity, Moody’s said. The combined bank’s net income to tangible assets will improve to about 1.6 percent from 1.2 percent and in line with the U.A.E. average of 1.7 percent, Moody’s said. Bloomberg

Record-breaking edition of Arabian Travel Market opens

Record-breaking edition of Arabian Travel Market opens

Latest innovations highlighted at Dubai FinTech Summit

Latest innovations highlighted at Dubai FinTech Summit

Qantas to pay AED 290 million to settle flight cancellation case

Qantas to pay AED 290 million to settle flight cancellation case

Warren Buffett's Berkshire Hathaway posts record operating profit

Warren Buffett's Berkshire Hathaway posts record operating profit

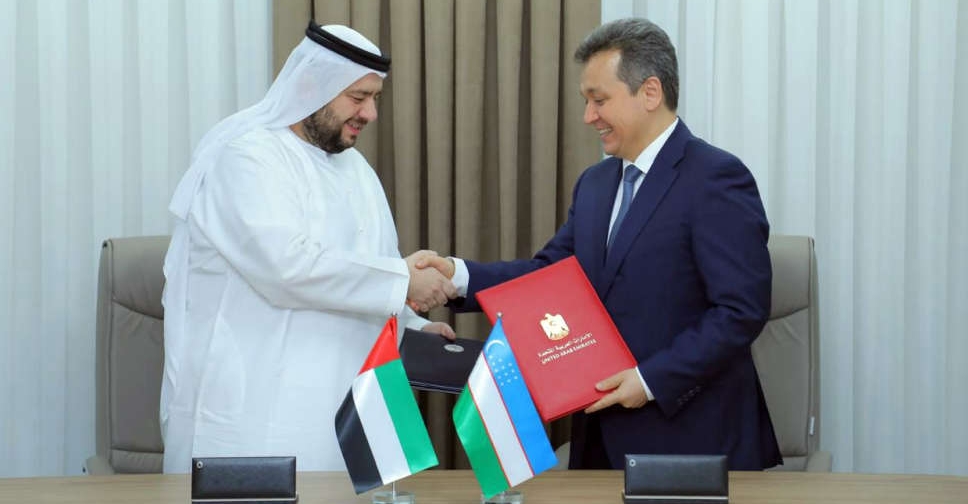

UAE, Uzbekistan sign digital infrastructure deal

UAE, Uzbekistan sign digital infrastructure deal